We will generate stable cash flow with a business portfolio resistant

to changes in the business environment and enhance corporate value

through flexible resource allocation.

Director, Managing Executive Officer,

Chief Financial Officer

Chief Officer for Corporate Administration Operations

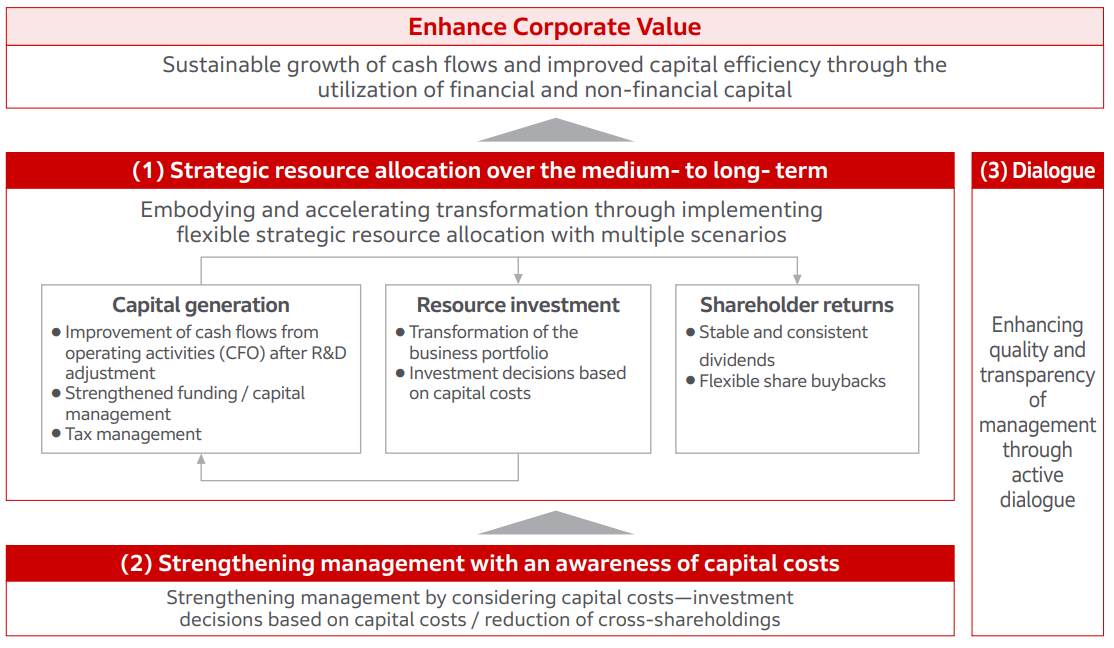

To enhance corporate value, we recognize the need to utilize both financial and non-financial capital to achieve sustainable cash flow growth and improve capital efficiency. To realize this, it is crucial to focus on (1) strategic resource allocation over the medium- to long- term, (2) strengthening management with an awareness of capital costs, and (3) improving management quality and transparency through proactive dialogue. I will explain the current situation and these initiatives in detail.

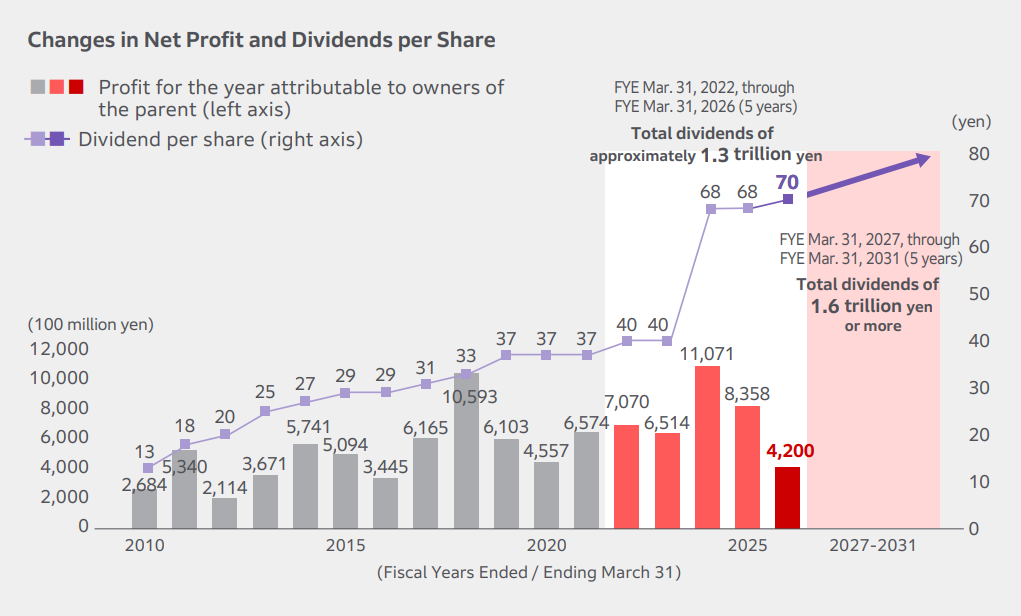

The results for the Fiscal Years Ended March 31, 2025, were operating profit of 1,213.4 billion yen and profit for the year attributable to owners of the parent of 835.8 billion yen. Profit declined from the previous fiscal year, but it maintained the same structure as the previous fiscal year, excluding the effects of changes in accounting treatment. The motorcycle business expanded mainly in Asia and South America, and continued to perform well. Its sales volume reached a record high, and operating profit also reached all-time highs.

The automobile business was mainly affected by a decrease in the number of units in the China/ASEAN region and the strengthening of incentives for electric vehicle (EV) sales in North America, but on the other hand, the business structure is steadily improving due to increased sales volume of hybrid electric vehicles (HEVs) and improvements in profitability. Furthermore, a resolution to acquire 1,100 billion yen of treasury stock was made in December 2024 for the purpose of optimizing capital accumulated from the past. From the perspective of improving capital efficiency and strengthening corporate governance, we are also accelerating the reduction of cross-shareholdings. Specifically, the number of such holdings was reduced by 13, from 46 stocks totaling 231.5 billion yen at the end of March 2024 to 33 stocks totaling 155.3 billion yen at the end of March 2025.

The forecast for the Fiscal Years Ending March 31, 2026 is based on operating profit of 700 billion yen and profit for the year attributable to owners of the parent of 420 billion yen, reflecting a negative impact of 450 billion yen from tariffs. Regarding the impact of tariffs, all effects known at the time of the announcement of financial results in August 2025 are reflected, but we will update them as appropriate according to changes in the situation.

The motorcycle business, which continues to perform well, is planning to achieve record-high sales volume. The automobile business is expected to expand further with HEVs, such as the “CIVIC HYBRID,” which was launched in North America in September 2024, despite the impact of tariffs and upfront investment in electric vehicles and software. In the financial services business, we are planning to generate stable profits based on a strong customer base.

Even in a highly uncertain environment with significant changes, we recognize Honda’s business portfolio resistant to changes in the business environment—including the motorcycle and financial services businesses—together with the automobile business, where profitability continues to improve centered on HEVs, as a strength Honda has cultivated over the years.

Honda has set a financial target, company-wide ROIC*1 of 10% or more for the Fiscal Years Ending March 31, 2031.

- ROIC: (Profit for the year attributable to owners of the parent + Interest expenses (excluding financial services business)) ÷ Deployed capital*2

- Deployed capital: Equity attributable to owners of the parent + Interest-bearing liabilities (Excluding those from financial services business sector). Deployed capital is calculated using the average of the beginning and end of the period.

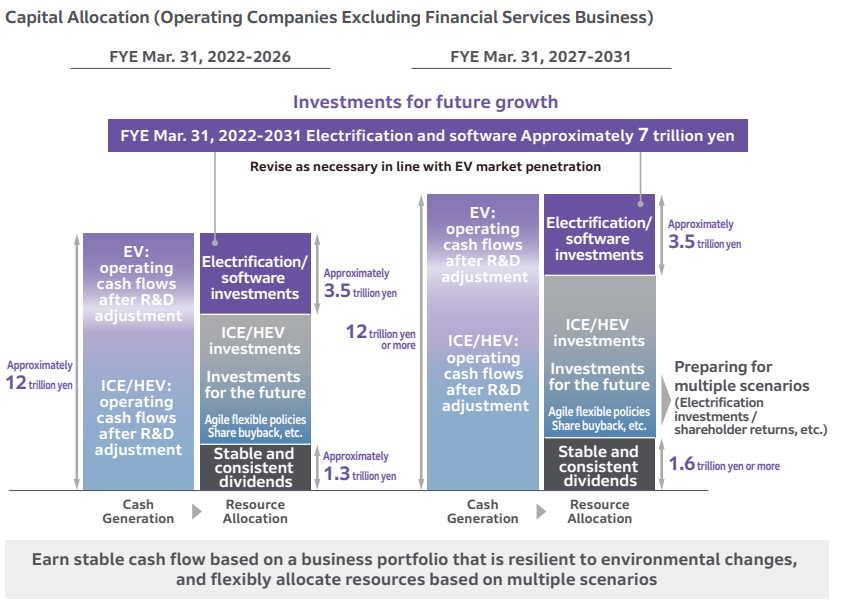

I will explain capital allocation (operating companies excluding financial services business) for future growth by dividing it into two phases: the five years from the Fiscal Years Ended March 31, 2022 through the Fiscal Years Ended March 31, 2026, and the five years through the Fiscal Years Ending March 31, 2031.

In the five years through the Fiscal Years Ending March 31, 2026, we expect to generate 12 trillion yen of operating cash flows after R&D adjustment*3, and in the subsequent five years through the Fiscal Years Ending March 31, 2031, we aim to generate more cash than in the preceding period. While earnings are currently weighed down by the impact of tariffs, we will enhance our cash generation capability through steady business expansion in the motorcycle business, stable cash generation in the financial services business, and improved profitability and higher sales volumes of next-generation HEVs to be introduced in the automobile business in 2027.

- Cash flows from operating activities (CFO) excluding R&D expenses: CFO of non-financial services businesses + R&D expenditures – amount transferred to capitalized development cost

In order to advance Honda’s electrification strategy, a key initiative toward achieving carbon neutrality by 2050, it is essential to allocate resources strategically at the right time. To achieve this, we plan to invest 7 trillion yen in the electrification and software domains over the 10 years through the Fiscal Years Ending March 31, 2031, to promote the adoption of EVs.

Also, in an uncertain environment where the pace of EV adoption is difficult to predict and rapid changes are taking place, we believe that flexible control of investment timing is crucial. Over the past year, in line with adjustments to our electrification strategy, we postponed comprehensive value chain construction in Canada and reviewed the timing for establishing a next-generation EV plant. As a result, resources allocated to the electrification and software domains over the ten years through the Fiscal Years Ending March 31, 2031, were reduced by 3 trillion yen, from 10 trillion yen to 7 trillion yen. Meanwhile, looking ahead to the future evolution of ADAS and autonomous driving, we see the creation of new value through intelligence as the source of future competitiveness, and we will continue to advance investment in the software domain as initially planned. As for next-generation ADAS, we plan to apply it broadly across the core lineup of EVs and HEVs, and will maximize the benefits of mass production.

Going forward, while considering multiple scenarios and carefully assessing changes in the market environment, we will pursue strategic resource allocation and agile capital policies.

Honda positions shareholder returns as one of its most important management priorities. With respect to dividends, we plan to pay a total of about 1.3 trillion yen over the five years through the Fiscal Years Ending March 31, 2026, and approximately 1.6 trillion yen over the five years through the Fiscal Years Ending March 31, 2031. In May 2025, we decided to adopt DOE*4 as a new return indicator to enable more stable and continuous dividends while maintaining appropriate equity capital. Although the environment remains uncertain, including the impact of tariffs, management has expressed its commitment to stable and continuous shareholder returns, supported by a resilient business portfolio that has maintained profitability even under severe conditions in the past. From the Fiscal Years Ending March 31, 2026, we will strive to pay dividends with DOE of 3.0% as a benchmark. Looking ahead, we aim to further enhance both capital efficiency and dividend levels.

With respect to treasury stock acquisitions, we will continue to carry them out as appropriate, with the aim of enhancing capital efficiency and pursuing agile capital policies.

- DOE: Ratio of dividend on adjusted equity attributable to owners of the parent

In order to respond flexibly and appropriately to changes in the business environment and enhance corporate value, Honda is embedding management practices that are conscious of capital costs, developing multiple scenarios based on different time horizons, and implementing flexible resource allocation. During this transformation phase, investments for the future will take precedence. At the same time, we are making investment decisions based on capital costs by utilizing net present value (NPV), while aiming to maintain company-wide ROIC above capital costs as a management threshold.

Honda’s corporate value in the stock market has continued to remain below 1.0x Price Book-value Ratio (PBR). However, when estimating the value of each business by applying the average sector multiple to the profits generated by each segment, we believe that Honda’s theoretical corporate value would significantly exceed its current market valuation.

While stock prices reflect factors beyond our control, such as policy trends in each country and the global economy, we believe that one reason for the divergence between Honda’s theoretical corporate value and its current market valuation is that we have not fully conveyed the cash generation capability of each business or the resource allocation strategies within our overall capital allocation.

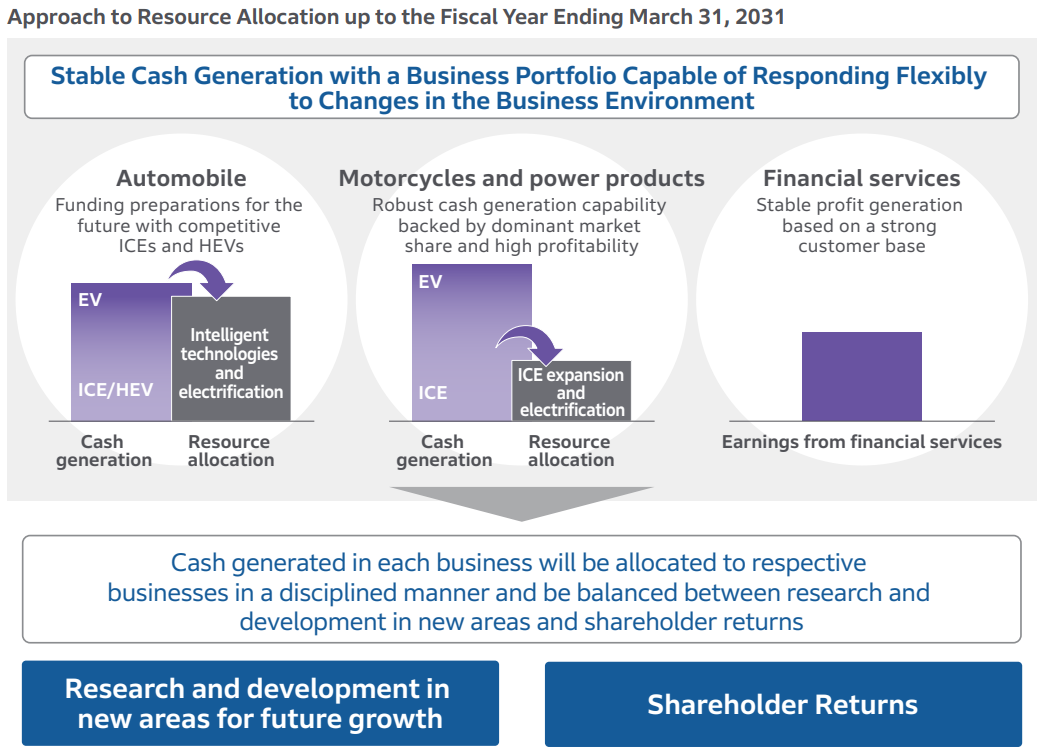

In explaining cash generation capability and resource allocation for each business toward the Fiscal Years Ended March 31, 2031, the motorcycle business recorded record-high sales volume in the Fiscal Years Ending March 31, 2025, and by continuing to capture demand growth—particularly in the Global South, including India, which is expected to become the largest market—we aim to sustain growth and generate cash while laying the groundwork for electrification.

The automobile business is generating cash mainly from ICEs and HEVs. Going forward, by positioning HEVs as a core pillar of earnings, we aim to further expand and improve profitability through initiatives such as creating new customer value by broadly applying next-generation ADAS to HEVs and introducing next-generation HEVs from 2027 onward. The cash generated in this way will be used to cover development costs and capital investments for intelligent technologies and electrification.

The financial services business generates profits mainly from stable vehicle sales and a strong customer base in North America. Given the nature of the business, which involves holding financial assets (receivables) over the contract period, we expect to continue securing stable earnings over the medium- to long- term.

Looking ahead to the Fiscal Years Ending March 31, 2031, we will use cash generated primarily from the motorcycle business, four-wheel ICE/HEVs, and the financial services business to support shareholder returns, resource allocation to electrification and software, and research and development of new businesses for the future. In the longer term, through the four-wheel electrification strategy, we will build a business structure capable of generating earnings with EVs, further enhancing our company-wide cash generation capability.

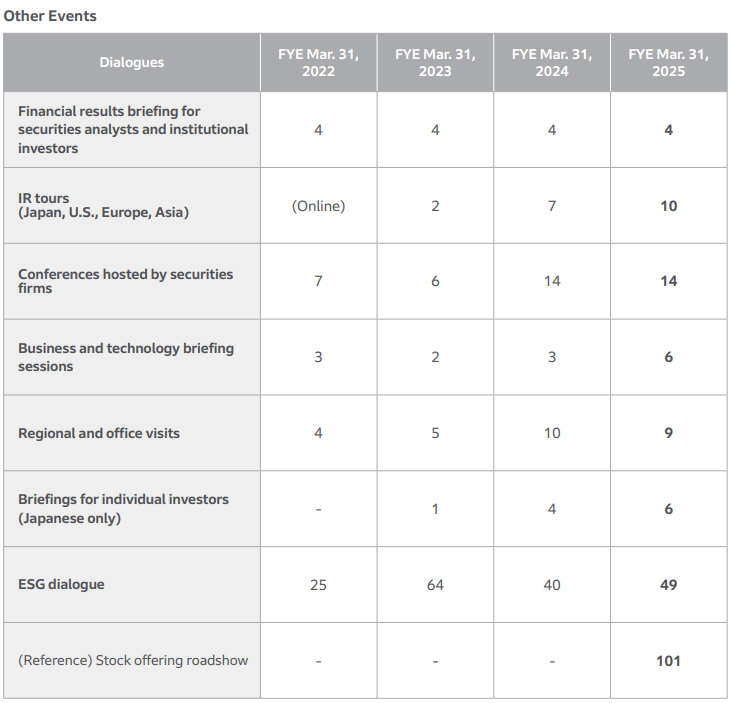

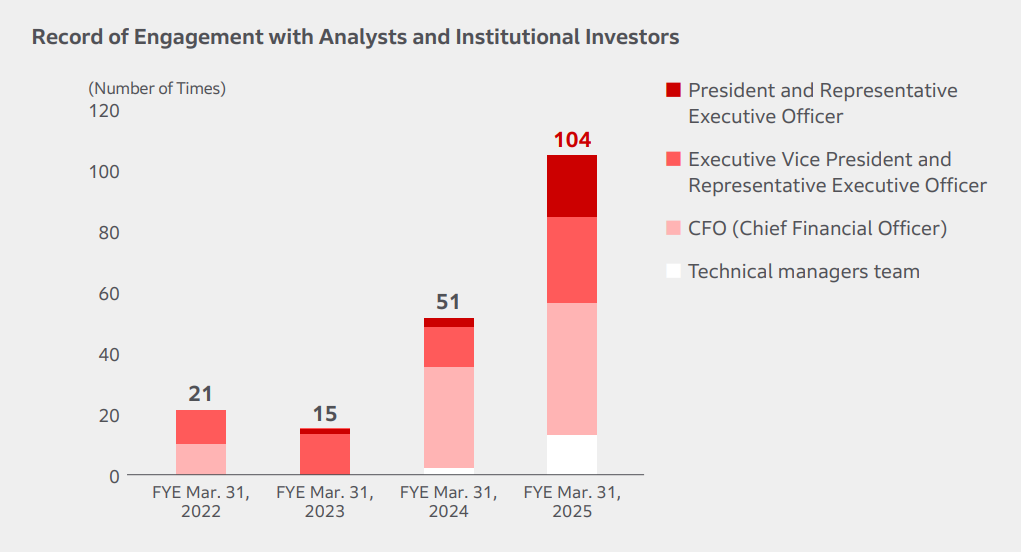

To ensure that stakeholders, including investors and individual shareholders, properly understand and evaluate the company’s management direction, the management team itself will take the lead in engaging in more proactive dialogue than ever before through events, individual meetings, and other opportunities.

At the beginning of each fiscal year, we hold a Business Update to communicate our mid- to long-term strategy, providing a forum to explain the environment surrounding Honda and the direction we aim to pursue going forward.

Following the Business Update, we conduct IR tours in Japan and overseas with the participation of management, actively engaging in two-way dialogue with investors to share details of our mid- to long-term strategy. In recent years, we have also increased the number of dialogues led by technology management in order to more clearly communicate Honda’s differentiating strengths.

At each quarterly earnings announcement, we explain both short-term results and the progress of our mid- to long-term strategy, with presentations given by the President, Executive Vice President, or CFO. To clearly communicate our technological strengths, we also host technology events on themes of high interest to the capital markets. In the Fiscal Years Ended March 31, 2025, these included the Honda 0 Tech Meeting 2024, where we unveiled next-generation technologies planned for the Honda 0 Series, a tour of the pilot line for all-solid-state batteries, and the Honda e:HEV Business and Technology Workshop, where we introduced next-generation e:HEV technologies.

In addition to domestic events, we also hold on-site events overseas, such as IR briefings in the United States—our main market for the automobile business—including small meetings at CES, and factory tours in India, a growth market for the motorcycle business.

Honda 0 Tech Meeting 2024

Honda e:HEV Business and Technology Workshop

Honda is also actively implementing initiatives aimed at expanding its individual shareholder base, encouraging longer-term shareholding, and increasing its fan base. In July 2024, with the aim of accelerating the reduction of cross-shareholdings, Honda conducted a secondary offering of shares held by non-life insurance companies and banks, with the majority of the offering allocated to individual shareholders.

We have also expanded briefings for individual shareholders, and in the Fiscal Years Ended March 31, 2025, we held a total of six sessions, combining both in-person and online formats.

Responding to shareholder requests for opportunities to experience Honda’s products and services, in recent years we have also focused on experience-based shareholder benefits. Starting in the Fiscal Years Ended March 31, 2024, we began offering flight experiences on the HondaJet light business jet as a shareholder benefit, which proved extremely popular with an application ratio exceeding 850 times in the previous fiscal year. This fiscal year, in addition to the HondaJet Trial Event, we are offering other Honda-unique benefits such as a Marine Test-Drive Event, Race Viewing, and a Safety School Trial Event.

HondaJet Trial Event

Marine Test-Drive Event

Through these dialogues, we seek to convey management’s and each technology leader’s commitment to our growth strategy, while directly understanding the expectations of the capital markets and reflecting them in our management and business strategies. In doing so, we aim to continuously enhance corporate value and remain a company that stakeholders look to with high expectations.